San Diego County District Attorney Summer Stephan is encouraging the public to report suspected fraud this week during International Fraud Awareness Week. Insurance Fraud is the second-largest economic crime in the U.S. and costs California residents about $15 billion a year. To combat this problem, the District Attorney, in conjunction with the California Department of Insurance, is shining a spotlight on this issue to minimize the impact of fraud by promoting anti-fraud awareness and education.

In 2022, the DA’s Insurance Fraud and Workplace Justice Division filed criminal charges against 202 defendants and obtained 171 convictions for various insurance fraud offenses. As a result of these convictions, nearly $30 million in restitution was ordered for victims, including individuals, insurers, and state agencies.

“Committing fraud is a serious financial crime that affects seniors, workers, employers along with business owners and corporations,” DA Stephan said. “When insurance prices spike because of unscrupulous actors and legitimate businesses can’t compete because of fraudulent businesses violating the law, or when employees are left vulnerable without the benefits they are entitled to, ultimately insurance fraud is felt by everyone.”

If you see, hear, or know of an insurance fraud scam happening in your area, please contact the DA’s Office through the Insurance Fraud hotline at (800) 315-7672 or at sdconnect@sdcda.org, or contact the California Department of Insurance at (800) 927-4357. To report fraud related to real estate, you can contact the DA’s Real Estate Fraud hotline at (619) 531-3552. To report any other type of fraud or criminal activity, please contact your local law enforcement agency.

The Insurance Fraud and Workplace Justice Division is dedicated to eradicating insurance fraud, whether it relates to workers’ compensation, automobile insurance, life insurance, or fraud in the healthcare industry. It also prosecutes other crimes uncovered during insurance fraud investigations, including wage theft, tax evasion and even labor trafficking.

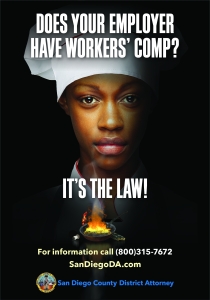

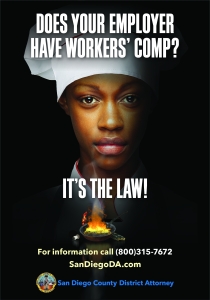

The Insurance Fraud and Workplace Justice Division also does outreach campaigns throughout the year, including during the month of November to coincide with Fraud Week. The campaign consists of digital, print, radio, television, DMV offices, transit stops, bus and trolley interiors as well as billboard advertisements to raise awareness about worker’s compensation fraud and auto insurance fraud and how to report it. Attached are some examples of the print outreach campaign.

The Insurance Fraud and Workplace Justice Division also does outreach campaigns throughout the year, including during the month of November to coincide with Fraud Week. The campaign consists of digital, print, radio, television, DMV offices, transit stops, bus and trolley interiors as well as billboard advertisements to raise awareness about worker’s compensation fraud and auto insurance fraud and how to report it. Attached are some examples of the print outreach campaign.

You can watch the worker’s compensation Fraud public service announcement here in English and Spanish. The auto insurance fraud PSA can be seen here. Funding for this outreach campaign comes from anti-fraud grant programs administered by the California Department of Insurance.

The DA’s Economic Crimes Division is responsible for prosecuting a wide variety of wrongdoing, including computer intrusion, identity theft, investment scams, embezzlements, real estate matters, counterfeit goods, environmental crimes and the theft of public assistance funds. The division also acts to protect consumers and businesses by successfully filing numerous civil cases to prohibit unfair business practices within the marketplace.

Examples of the types of crimes that the Insurance Fraud and Workplace Justice Division prosecutes are:

- Workers’ Compensation Provider Fraud – When medical and legal providers, including doctors, chiropractors, and lawyers are paying or receiving kickbacks for referrals, billing for services not rendered or overbilling for services provided.

- Workers’ Compensation Premium Fraud – When a business misrepresents its true payroll, the type of work it performs, or conceals employee injuries to pay lower workers’ compensation premiums. One of the most common premium fraud schemes occurs when employers pay employees in cash without reporting that cash payroll to the Employment Development Department and their insurer. This activity results in $7 billion in lost revenue each year and evasion of approximately $6.5 million in payroll taxes annually. Frequently, employers who commit premium fraud also engage in other crimes, including wage theft, tax evasion, and labor/human trafficking.

- Workers’ Compensation Applicant Fraud – When employees fake or exaggerate work injuries to collect workers’ compensation benefits, or when employers make false statements to deny benefits to injured workers.

- Uninsured Employers – Every business in California is required to have workers’ compensation insurance to cover its employees in the event of a workplace injury. These cases are especially important because if an employee is injured at work and their employer does not have workers’ compensation insurance, the employee may have no recourse to get required care and benefits.

- Auto Insurance Fraud – Fraudulently obtaining payment on an auto insurance policy based on false information such as inflated or faked damages, staged collisions, false claims of vehicle theft and arson. This fraud costs consumers billions of dollars each year in the form of higher insurance premiums.

- Disability and Healthcare Fraud – This involves fraudulent medical and disability claims and policies, including medical providers who fraudulently bill insurance companies or who divert medications for personal use or sale. Healthcare fraud increases medical costs for everyone.

- Life and Annuity Fraud – Unscrupulous life insurance agents and others who seek to steal the savings of victims through power-of-attorney abuse, securities fraud, and fraudulent claims on legitimate policies. These scams often target senior citizens, and the impact is life-altering, since seniors do not have the time or opportunity for financial recovery.

- Workplace Justice Violations – We have developed an innovative approach to the prosecution of wage theft, wage and hour violations, meal and rest break abuses, unfair business practices, tax evasion, and labor trafficking.

In 2022, the Economic Crimes Division filed criminal charges against 177 defendants and obtained 228 convictions. Additionally, from those convictions, defendants were ordered to pay over $4.4 million in restitution.

This division also pursued civil enforcement actions against various businesses for unfair competition or environmental violations. In 2022, the Consumer Protection and Environmental Protection Units completed over a dozen major civil enforcement actions resulting in injunctions to stop the unlawful business practices and statewide monetary relief that included millions of dollars in civil penalties, costs and restitution.

Some examples of the types of cases that the Economic Crimes Division prosecutes are as follows:

- Real Estate Fraud – This type of crime involves various fraudulent real estate transactions and/or schemes such as the submission of forged loan applications; fraudulent transfers of title of real property; recordation of fraudulent real estate documents; home equity sale contract fraud; and mortgage foreclosure consultant fraud.

- Computer and Technology Crimes High Tech Task Force (CATCH) – This Unit prosecutes high-technology criminals engaged in crimes where technology is the prime instrumentality of the crime, or where technology is the target of the crime, such as; theft facilitated by technology, theft of technology resources, network intrusions, online harassment and stalking, as well as providing technical and investigative assistance to local law enforcement agencies with respect to digital forensics.

- Identity Theft – These crimes usually involve criminals acquiring key pieces of someone’s identifying information to impersonate them and commit numerous forms of fraud which include taking over the victim’s financial accounts, opening new bank accounts, purchasing automobiles, applying for loans, credit cards, and social security benefits, renting apartments, and establishing services with utility and phone companies.

- Complex Theft – These crimes commonly involve embezzlement or investment scams. Embezzlement is the fraudulent appropriation of property by a person to whom it has been entrusted. Instead of using the company’s payroll system or checking or credit card account for legitimate company business, the individual uses these accounts to steal by directing the money to his or her own accounts or to pay for personal expenses. Grand theft schemes take many forms but include scams where the perpetrator misleads individuals about an investment opportunity and instead the uses the money to support the perpetrator’s lifestyle.

- Consumer Protection – These cases generally involve a business or an individual taking advantage of consumers. These cases can range from a business failing to warn a consumer that their credit card will be billed on an ongoing basis to a business using scanners that charge an amount over the advertised price to building contractors operating without a license. These cases also include other unfair business practices such as misleading product labeling or false advertising.

- Environmental Protection – These cases generally involve businesses that violate rules relating to the environment such as hazardous waste disposal, underground storage tank regulations and clean air act statutes.

“If you know of fraud being committed, report it because it’s important to hold accountable those who would break the law,” DA Stephan said.

For information and resources about International Fraud Awareness Week, visit www.FraudWeek.com.

The Insurance Fraud and Workplace Justice Division also does outreach campaigns throughout the year, including during the month of November to coincide with Fraud Week. The campaign consists of digital, print, radio, television, DMV offices, transit stops, bus and trolley interiors as well as billboard advertisements to raise awareness about worker’s compensation fraud and auto insurance fraud and how to report it. Attached are some examples of the print outreach campaign.

The Insurance Fraud and Workplace Justice Division also does outreach campaigns throughout the year, including during the month of November to coincide with Fraud Week. The campaign consists of digital, print, radio, television, DMV offices, transit stops, bus and trolley interiors as well as billboard advertisements to raise awareness about worker’s compensation fraud and auto insurance fraud and how to report it. Attached are some examples of the print outreach campaign.