Teacher Who Committed Sex Crimes against two Underage Students Sentenced to Prison

San Diego County District Attorney Summer Stephan said today that a teacher who inappropriately engaged in sexual relationships with two underage students has been sentenced to six years in prison after pleading guilty to seven felony counts of related to various sex crimes.

Kyiri Tisdale, 32, a former teacher at Escondido High School, was arrested in August 2024 following an investigation by the Escondido Police Department’s Family Protection Unit. He was arrested at school while preparing for the upcoming school year.

“This defendant used his position of trust as a teacher to commit sex crimes against teenage students whom he’s supposed to nurture and protect,” DA Stephan said. “He not only physically violated his students but also violated the trust that the overwhelming number of teachers in our county work so hard to build with their students. There is no room in our schools for corrupt teachers who abuse their positions of trust to gain the confidence of students, only to take advantage of them sexually. I hope today’s sentence serves as a warning to anyone in a position of power that the truth eventually comes out, and you will be held accountable. I am proud of the victims for coming forward and I hope the end of this case provides the closure they need to move on and live healthy lives.”

Tisdale was 29 when he began the first sexual relationship with a 17-year-old student. While that conduct was ongoing, Tisdale committed several illegal sexual acts with a separate, 16-year-old victim.

Detectives with Escondido Police worked quickly to investigate when the report from the first victim came to light just days before the start of a new school year. They developed enough information to make the arrest even as Tisdale was in his classroom, prepping for classes to start and to meet a new group of students. After the arrest, the District Attorney’s Office worked with detectives to locate and speak to the second victim, developing further evidence for additional criminal charges.

Every student in San Diego County deserves to have a safe and nurturing educational environment, free of sexual and physical abuse. But if that kind of abuse does happen, students, parents and teachers should report to their local police department or Sheriff’s Office. If anyone suspects any misdeeds related to schools but is uncertain about what to do, they can report to the District Attorney’s Office at https://www.sdcda.org/helping/studentsafety/.

Once suspected abuse is reported, the task force members will evaluate and investigate the claim, law enforcement will be notified to investigate allegations when appropriate, and families will be connected with trauma-informed resources and support.

Another important public safety reminder is that mandated reporters have a duty under the law to report suspected child abuse, which includes sexual abuse.

Deputy District Attorney Peter Estes from the DA’s Sex Crimes and Human Trafficking Unit prosecuted this case.

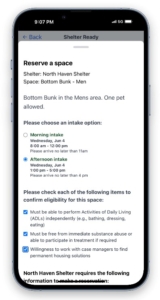

Shelter Ready is a transparent and efficient platform that helps frontline workers quickly locate and refer unsheltered individuals to appropriate shelter beds. It was developed in partnership with a national technology nonprofit and informed by input from dozens of San Diego County agencies. Over the past several months, the app has been piloted successfully in the North County with several local organizations and is now being made available countywide—at no cost—through leadership from the DA’s Office.

Shelter Ready is a transparent and efficient platform that helps frontline workers quickly locate and refer unsheltered individuals to appropriate shelter beds. It was developed in partnership with a national technology nonprofit and informed by input from dozens of San Diego County agencies. Over the past several months, the app has been piloted successfully in the North County with several local organizations and is now being made available countywide—at no cost—through leadership from the DA’s Office.